Market mechanism - a designed (rather than spontaneously emerging) market.

Market mechanisms are often engineered with policy goals in mind. Among the most well-known (and controversial) of these is the Kyoto Protocol's Clean Development Mechanism for issuing and trading GHG emissions permits.

Project Persephone studies market mechanisms for how they can substitute for (and even improve upon) bureaucratic governance. (Democratic governance is also a goal -- they aren't mutually exclusive.) Market mechanisms could be designed for exovivaria governance and for the organization itself. The mechanisms can be tested in virtual exovivaria and terrestrial prototypes of exovivaria. Where proven already elsewhere, such mechanisms could apply to communities in equatorial mountain regions that have been selected as Project Persephone aid beneficiaries, wherever the local culture is open to such experiments.

Here are some market mechanisms under consideration:

Prediction markets for planning

Prediction markets have been used for a variety of applications in organizational (mainly corporate) decision-making, even if they are mostly famous as a way to bet on political outcomes. Project Persephone's uses can include markets for betting on policy outcomes as a source of cautionary advice on majority rule (i.e., futarchy1), estimating likelihood of success for proposed projects2, and for predictions of time-required for tasks in project schedule estimation. The scope of the use of such markets in projects planning and policy impacts need not be limited to exovivaria. Projects and policies in the developing world could also benefit from mechanisms that turn up "hidden information," especially if anonymized, since calling out corruption when it's seen too often exposes the caller to retribution.

Augur is a new prediction market based on blockchain technology

Georgist taxation for equitable funding of non-market governance

Henry George proposed that only land property value be taxed, which earned his followers the simplified term, Single Taxer. Well, who was it who said that things should be made as simple as possible but not simpler? Still, economists left and right have seen merit in the idea.3

Exovivaria will require some government, and governments need income. A tax only on the value of exovivarium interior spaces minus the value of their improvements would help foster an unhindered market for improvements. The value of areas (and volumes) minus the value of improvements on (and in) them could be determined by a free market for internal space combined with competition in a market for (mandated) insurance on all improvements. So the real market mechanism here is that insurance mandate. And why not have one?

Exovivaria could, after all, be damaged or lost through orbital debris impacts, among other kinds of incidents. Then there are the more localized kinds of damage. One owner's loss isn't necessarily confined to that owner -- if your house is on fire, that fire can jump to a neighbor's house. This kind of contagion of disaster can't be ruled out in exovivaria.4

Georgism envisions a market economy with taxes based only on the value of land

Emissions trading markets for ecosystem protection and management.

In emissions trading, people can buy and sell rights to pollute. Critics of emissions trading have voiced moral objections to the idea of owning a right to make the world worse. But if the trading is the most efficient way to make a world better, you have to wonder if this isn't really an issue more in the domain of ethics than morals. Making the world a little worse is sometimes inevitable anyway. So why not at least pay for it, so that others who are improving the situation can be rewarded for doing so?

There are some obvious pollutants in a closed ecosystem -- any excess can be considered a pollutant. (Even oxygen, if it's increasing the fire risk.) Exovivaria will require keeping ecosystems alive with a very high ratio of "technosphere" mass to natural resource mass compared to the Earth's surface. User preferences for biomass will also tend toward a higher-than-natural fauna-to-flora ratio, since animals are more interesting to watch and interact with than plants. These two factors will greatly increase the need to balance emissions with consumption.

And the idea of "emissions" isn't necessarily limited to substances. In a habitat rotated for artificial gravity, even the movement of animals and user telebots, and the flow of water, could be classified as "emissions"; such movement, if ill-timed, could interfere with the effort of keeping the exovivarium's solar collector pointed toward the sun; however, if well-timed, they could be used to maintain the exovivarium's orientation.5

Cap-and-trade is a way to reduce and control emissions by buying and selling rights to pollute

Resource exchanges for physical design

Resource exchanges allow engineers to buy and sell 'resource slack' in the design of systems that are under tight physical constraints.6 These could certainly be applied to virtual exovivaria and terrestrial prototypes; they might also apply to various picosatellite proof-of-concept experiments. Given the complexities and constraints of exovivaria, resource exchanges might even prove valuable to users in their property improvements within exovivaria.

However, well before there are real exovivaria, or terrestrial prototypes, or virtual-world versions, the idea of a resource exchange could be applied to the problems that developing-world communities face in deciding how to allocate resources for their own mutual-good projects. It could be more liquid form of Participatory Budgeting.

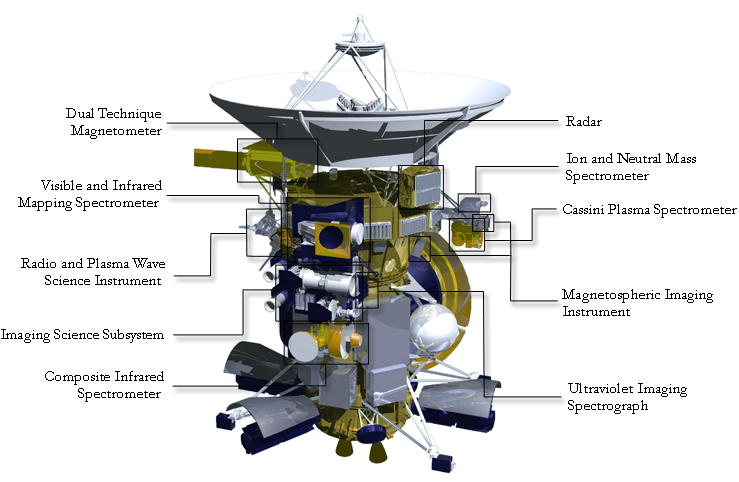

The Cassini Resource Exchange brought a complex, over-schedule, over-budget space probe project under control

Citizen Rights to Equal Shares in Enterprises

This idea has also been called coupon socialism, not exactly the most attractive term.7 The idea is reminiscent of Georgism: just as we're all "inheritors of the Earth", we are all, in some sense, inheritors of the economy's existing productive capacity. What if everybody got equal shares in all enterprises, and could trade them, for whatever they thought would optimize their dividend income? It's been argued persuasively that we'd all be better off.

Project Persephone will adopt localities in equatorial mountain regions near areas selected as candidate projectile space launch sites. The Project may emphasize employing local populations to build terrestrial prototypes of exovivaria and as telebot operators. Assigning potentially dividend-paying coupons to citizens in such areas enfranchises them in the success of the Project, including the success of enterprises affiliated with it -- especially enterprises that might employ them. Concurrently, we might fund local enterprises less closely related to the Project Persephone agenda, on terms where capital is available only if the equity shares are distributed equally in the area.

Needless to say, if and when exovivaria fly, enterprises operating in them can be subject to the same citizen-equity discipline.

Market economies are possible without self-reinforcing concentrations of capital

Bancor-style international trading units

The Bancor was proposed in the aftermath of WW II as way to create developed-nation incentives to increase investment in developing world nations while reducing developing world debt.8 For whatever reason, it didn't work out, and it's been argued that the world (and not just the developing world) is the poorer for it.

For Project Persephone, the purpose would be to immunize funding of aid projects against exchange-rate fluctuations, and to help to ensure that trade among Project members flows toward selected equatorial mountain regions. When the Project as a whole is suffering coordination failures or internal political deadlock, a liquidity channel to members in its aid-beneficiary regions would at least help keep benefits flowing; individual donors could still buy goods and services from individual aid beneficiaries.

The international monetary system we have is not the only one possible

Microfinance-inspired funding channels to beneficiary regions

Microfinance-inspired approaches to fostering entrepreneurial activity in the beneficiary regions could help foster loyalty to the program in places where skepticism about its goals would be understandable. One form of microfinance, microcredit, has proven to be problematic, often satisfying the desires of donors (and MFI loan officers) more than the real needs of selected beneficiaries.9 A micro-equity approach would probably be more appropriate, especially if the shareholding rights take the more communitarian form of coupon socialism. Equity does not open the trap of debt-servitude, while it does open a path of microfinancialization for those who are forbidden by their religious beliefs from earning interest. As well, share-pricing partakes of much the same logic as prediction markets, which perhaps would make it more likely to foster successful enterprise.

Once seen almost as a panacea for poverty, microcredit luster has been tarnished by low returns and loan-shark interest rates

Forward markets for prevention of asset bubbles

Forward markets ordinarily go by the less savory term, "short-selling" but they can help suppress bubble behavior if structured the right ways.10 If the high costs of exovivarium launch can be met with promises to deliver on-orbit "real estate" to sufficiently charitable donors, there would still be the risk that those donors would fall prey to "irrational exuberance" in trading that not-yet-real estate among themselves. Such a market failure could prematurely signal that exovivarium launch had become economically feasible. It would be better for all concerned to get the timing right.11 In the longer run, rising prices for exovivarial real estate could signal that it's time to launch more exovivaria. This signal is more likely to be taken seriously by investors if there's a case that it's not bubble behavior.

Experimental economics suggests bubbles can be dampened

Notes

1 Because pure futarchy as originally described by Robin Hanson will fall afoul of disagreements over its democratic legitimacy, small-sample processes such as deliberative polling can be iteratively applied after "circuit breaker" petitions suspend what would otherwise have been automatic resource allocations; see governance for Project Persephone. ⇑

2 More research into "thin markets" could be required to make prediction markets workable in the Project Persephone context, since design of exovivaria will often require rare specialist expertise. See e.g., Michael Abramowicz, "The Hidden Beauty of the Quadratic Market Scoring Rule: A Uniform Liquidity Market Maker, with Variations" (PDF) and "Inducing Liquidity In Thin Financial Markets Through Combined-Value Trading Mechanisms," John Ledyard, Peter Bossaertsa, Leslie Finec. European Economic Review 46 (2002) 1671-1695 ⇑

3 Although Georgism is historically associated with progressive social reform, a tax on the unimproved value of land was also deemed by the more-Libertarian Milton Friedman to be "the least bad tax" (Mark Blaug. Economica, New Series, 47, no. 188 [1980] p. 472). ⇑

4 Fires are not exactly unknown, in spacecraft. The Apollo 1 capsule interior was destroyed by a fire made more intense by a pure oxygen atmosphere, taking the lives of three astronauts. There was a fire aboard the Mir space station, possibly 14 minutes long, caused by the malfunction of a chemical oxygen generator. ⇑

5 Users might be able to earn and sell "motion permissions", not just be required to buy them. For one investigation into spacecraft attitude control using movement of internal masses see "Internal Mass Motion for Spacecraft Dynamics and Control: Final Report", Christopher D. Hall, Virginia Tech, 01-05-2008 ⇑

6 See e.g. the discussion of the Cassini Resource Exchange in "The Experimental Economist", Reason magazine, October 2002; "A Market-Based Mechanism for Allocating Space Shuttle Secondary Payload Priority," (PDF), John Ledyard, David Porter, Randii Wessen, in Experimental Economics 2(3) 173-195 DOI: 10.BF 01669195?; see also the post-Cassini work of Randii Wessen on resource exchanges for robotic spacecraft design. ⇑

7 For some detailed critiques of Coupon Socialism, see 1994: Equal Shares: Making Market Socialism Work. John Roemer. London & New York: Verso, 1996. ISBN 1859849334 ⇑

8 See "How Keynes' Bancor International Trade Currency Would Work", Prosperity UK, 2003 ⇑

9 As Elliott Prasse-Freeman notes of a major journalist booster of microcredit: "While Kristof is correct to note that good intentions and hard work are not enough to effectively help people, he neglects to mention that they are quite sufficient to fulfill his own expectations". From "Petit Bourgeois Fantasies: Microcredit, Small-Is-Beautiful Solutions, and Development's New Antipolitics", in Seduced and Betrayed: Exposing the Contemporary Microfinance Phenomenon, M. Bateman, K. Mc Clean? (eds.), 2016, University of New Mexico Press, ISBN-13: 978-0826357960 ⇑

10 See e.g., "Can Markets Learn to Avoid Bubbles?", Ross M. Miller (Miller Risk Advisors), Journal of Psychology and Financial Markets, 2002 ⇑

11 NewSpace development has fallen prey to bubbles in the past, although there was no open-market "real estate" being staked out; the orbital assets of Iridium and other late-90s satellite phone companies eventually sold for pennies on the dollar. ⇑

This page may have a more recent version on pmwiki.org: PmWiki:MarketMechanisms, and a talk page: PmWiki:MarketMechanisms-Talk.